Cost-Benefit Analysis

What is Cost-Benefit Analysis?

Cost-Benefit Analysis is a systematic and evidenced-based approach for appraising and evaluating the economic, social, environmental, and cultural impacts of projects, programs, and policies, relative to their costs. By expressing impacts in monetary terms where feasible, and describing important impacts qualitatively where monetisation is not possible, CBA provides a structured basis for assessing net impacts and value for money, and for supporting transparent decision-making.

Widely used by governments, cost-benefit analysis is the preferred method of economic assessment for most treasury departments because it provides a comprehensive and evidence-based way for assessing costs and benefits, and value for money.

When is CBA used?

We undertake ex-ante (forward-looking) and ex-post (backward-looking) CBAs to support:

Business cases and investment decisions

Economic evaluations of programs and policies

Appraisal and evaluation of government advertising and communications

Regulation and regulatory impact statements

Impact assessments

Why Choose us?

Proven experience: More than 150 CBAs delivered for 25 different state and federal government departments and agencies.

Technical depth: We have deep technical expertise in CBA across diverse sectors.

Experts in CBA for NSW Government advertising: Since 2011, we have helped NSW agencies prepare CBAs for major government advertising campaigns, ensuring compliance with statutory and other requirements, and supporting them through approval processes. Learn more here.

Independent & evidenced-based approach: Our independent, evidence-based approach to CBA helps organisations to appraise options, evaluate outcomes, inform decision-making, and demonstrate value.

Training and capability building

We deliver professional training and capability-building services in CBA. Our workshops - available as customised in-house or public sessions, in-person or virtual - equip participants with the essential skills and knowledge in cost-benefit analysis that they need. Our first public program in 2026 can be booked here.

Resources

Planning or commissioning a CBA? Explore our comprehensive selection of useful Resources for Cost-Benefit Analysis to guide you through the process.

Ready to Get Started?

Contact us to discuss your project or training needs.

Examples of Our Work

Relationships Australia Victoria

Relationships Australia Victoria (RAV) is a community-based, not-for-profit organisation that has been providing family and relationship support services since 1948. Its services include counselling, family dispute resolution (FDR), relationship education and group programs, family violence and mental health services, workplace support, and professional training.

RAV pioneered FDR in the mid-1980s and continues to be one of Victoria’s largest providers. FDR, also called family mediation, helps separating couples resolve their family law disputes.

Amendments to the Australian Family Law Act 1975 (Cth) in 2006 made it mandatory for separating parents to attempt FDR before applying to the courts for parenting matters. There is currently no such mandatory requirement for property matters.

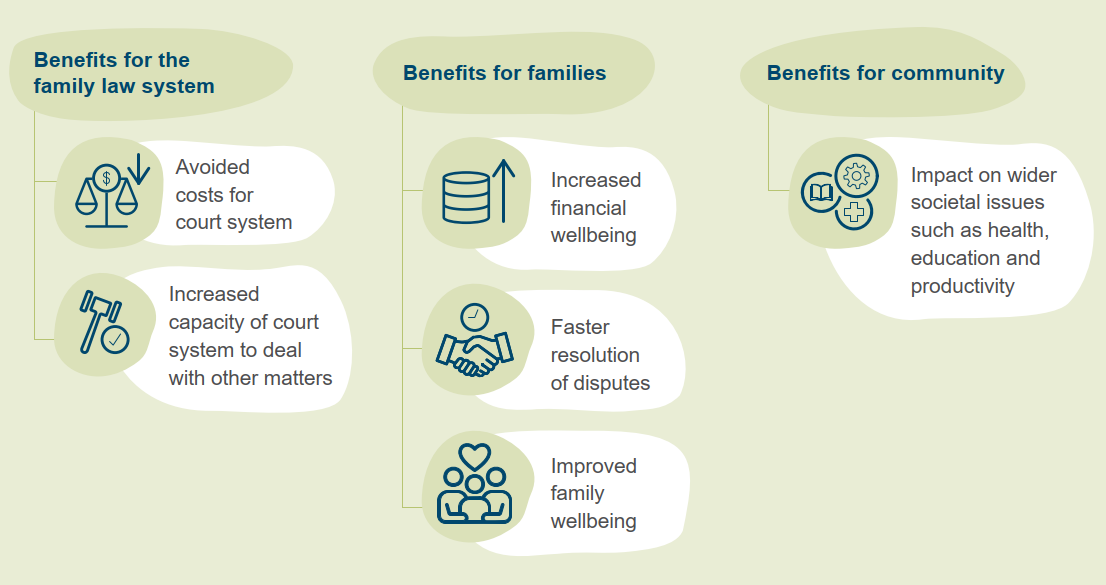

Benefit framework for family dispute resolution services

We worked with Relationships Australia Victoria to undertake a cost-benefit analysis (CBA) of its FDR services. To date, most cost-benefit analyses of FDR and other similar services have focused on benefits for the family law system and avoided government costs. Our analysis used de-identified, self-assessed client outcomes and other data to estimate benefits for families, including improved family wellbeing and increased financial wellbeing. The results indicate that FDR delivers substantial social and financial net benefits.

A second CBA examined the potential net benefits of making FDR mandatory for property matters. Extending the requirement to property matters would, on our estimates, increase net benefits further, primarily through additional financial gains for families.

A summary of our findings and the full reports can be found here. To learn more about FDR, visit here.

Australian and New Zealand National Council for fire and emergency services (AFAC) – Australian Fire Danger Rating System Program

Fire Danger Ratings as known by Australians for many years.

In Australia, formal fire danger ratings were developed by A. G. McArthur in the 1950s and 1960s. The McArthur system was used for many decades and was periodically updated.

In 2022 it was replaced by the Australian Fire Danger Rating System (AFDRS), a generational change in how fire danger is calculated and communicated.

The AFDRS assesses fire danger through two components:

Fire Danger Ratings (FDR): a simple, community-facing scale with four levels, clear names and colours, broad risk categories, and distinct action-oriented messages for each level.

Fire Behaviour Index (FBI): a numeric scale (0–100+) used consistently across Australia. Higher values indicate more dangerous fire behaviour. The FBI supports decisions that require finer detail than the four public rating levels, particularly for fire management professionals and decision-makers.

Since 2022, Australia has had a new, simplified, action-oriented fire danger rating system.

The AFDRS Program was nationally significant. Following the development and testing of a working research prototype, we worked with the AFDRS Program Team to prepare cost-benefit analyses supporting the Gateway Review processes for the later phases of the program, which delivered both the new Fire Danger Ratings and the Fire Behaviour Index, including the operational build of the underlying infrastructure that enables the latest science, technology and data to be used to produce accurate and timely fire danger information

For more information on the new rating system, visit the Australian Fire Danger Rating System .

Cancer Institute NSW – Bowel Cancer Screening Campaigns

National Bowel Cancer Screening Program test kit

Between 2019 and 2023, the latest five years of available data, bowel cancer accounted for around one in ten new cancer diagnoses (9.7%) and more than one in ten cancer deaths (10.9%) in the state, making it one of the most common and deadliest cancers.

Outcomes improve markedly when bowel cancer is detected early. In Australia, five-year relative survival is 98.6% for people diagnosed at stage 1 and 88.6% for those diagnosed at stage 2, compared with much lower survival for cancers detected at later stages. Early detection can mean simpler treatment, fewer complications, and a greater likelihood of returning to usual activities.

The National Bowel Cancer Screening Program invites Australians aged 50-74 years to screen for bowel cancer using a free home test kit mailed to eligible people every two years. Since July 2024, people aged 45 to 49 have also been able to request their first bowel cancer screening kit.

Increasing participation in this program is one of the most effective ways to reduce the number of people who die from bowel cancer.

The Cancer Institute NSW is responsible for developing, implementing, and evaluating social marketing programs to encourage bowel cancer screening in NSW.

We have worked with the Cancer Institute NSW to prepare cost-benefit analyses for their bowel cancer screening campaigns, in accordance with Section 7 (1) of the Government Advertising Act 2011 and other relevant requirements.

These campaigns have included the ‘There’s A Lot We Can Do’ creative. Fronted by Australian physician and media personality, Dr Norman Swan, the advertisement encourages people 50-74 years to use the home test kit to help fight bowel cancer.

More about bowel cancer screening campaigns.

We have also worked to prepare cost-benefit analyses for many other NSW Government advertising and social marketing campaigns; you can read more about this work on our Government Advertising Campaigns page.

Resources for Cost-Benefit Analysis

If you are planning or commissioning a cost-benefit analysis, useful resources include:

Australian General Guidance on Cost-Benefit Analysis

NSW Government Guide to Cost-Benefit Analysis (TPG23-08) - a Treasury Policy and Guidelines paper that sets out how to undertake cost-benefit analysis for NSW government initiatives. It also describes the role of cost-benefit analysis in supporting evidence-informed decision making and provides guidance for practitioners. It is central to the NSW investment framework for the appraisal and evaluation of public investments.

NSW Government Technical Note on Choice Modelling (2025) - supplementary guidance under TPG23-08 that introduces choice modelling for public policy and offers practical guidance on its application, survey design, and presenting results.

NSW Government Technical Note on Ex-Post Cost-Benefit Analysis (2023) - supplementary guidance under TPG23-08 for undertaking ex-post cost-benefit analysis when an initiative is underway (interim or ‘in media res’ ex-post CBA) or completed (final ex-post CBA) to assess the net social benefits of an implemented initiative.

Commonwealth Grants Rules and Principles 2024 - updating the previous Commonwealth Grants Rules and Principles 2017, the new guidelines formalize the requirement for cost-benefit analysis: “Grants administration should provide value, as should the grantees in delivering grant activities. This requires the careful comparison of the costs and benefits of feasible options in all phases of grants administration.”

Australia’s Impact Analysis Framework (2025) - the IA framework addresses 7 specific questions designed to assist decision makers understand the potential impacts of policy options, including ‘what is the likely net benefit of each option’ (the recommended option should always be the option with the greatest net benefit to Australia). Only major policy changes likely to have significant impacts require an IA. The Australian Government Guide to Policy Impact Analysis gives further detail (pp. 13–42).

Australian Government Guide to Policy Impact Analysis (2023) - replacing the Australian Government Guide to Regulatory Impact Analysis, the new guide is intended to inform policy making by the Australian Government by ensuring that advice to government is accompanied by robust analysis, data, and an accurate overview of the effects of proposed policies on the community. This analysis includes measuring the net benefit of each policy option by taking into account all of the costs and benefits.

Australian Government Cost-Benefit Analysis Guidance Note (2023) - this note provides guidance to policy makers on the use of cost-benefit analysis for policy proposals, and is relevant for policy makers working on proposals made by both the Australian Government or intergovernmental decision-making bodies.

Victoria State Government Economic Assessment Information Portal - access to guidance on how to undertake an economic assessment (cost-benefit analysis is the preferred form of economic assessment) to inform decision making across the Victorian Government.

Victorian Guide to Regulation (2024) - guidance issued by Victoria State Government for developing policy proposals and regulatory impact assessments.

Victorian Economic Evaluation for Business Cases - Technical Guidelines (2013) - guidelines issued by Victoria State Government for the economic appraisal of investment decisions (with cost-benefit analysis the preferred approach) in relation to economic and social infrastructure.

Queensland Project Assessment Framework - Cost-Benefit Analysis Guidelines (2024) - provides practical guidance regarding the range of issues to consider when conducting a financial and economic analysis of project options at either the preliminary appraisal/evaluation or business case development stages of the project lifecycle.

Key Texts and Journals on Cost-Benefit Analysis

Society for Benefit-Cost Analysis - working to improve the theory and practice of benefit-cost analysis and to support evidence-based policy decisions.

Journal of Benefit-Cost Analysis - the only journal devoted exclusively to benefit-cost analysis, it publishes theory, empirical analyses, case studies, and techniques.

Cost-Benefit Analysis Concepts and Practice 5th Edition (2018) by Anthony E. Boardman (Author), David H. Greenberg (Author), Aidan R. Vining (Author), David L. Weimer (Author) - widely cited, it is recognized as an authoritative source on cost-benefit analysis.

Cost-Benefit Analysis Tools

NSW Treasury Cost-Benefit Analysis Tool (2024) - excel workbook developed to support analysts to conduct calculations in cost-benefit analysis.

NSW Treasury Rapid Cost-Benefit Analysis Tool User Guide (2024) - provides details of the Tool’s functions, parameters and inputs and provides a step-by-step guide in how to use the Tool.

NSW Treasury Quality Assessment Tools (2024)

Ex-ante Cost-Benefit Analysis Quality Assessment Tool supports reviews aligned to the Guide to Cost-Benefit Analysis (TPG23-08)

Ex-post Cost-Benefit Quality Assessment Tool supports reviews aligned to the Evaluation Guidelines (TPG22-22), Guide to Cost-Benefit Analysis (TPG23-08) and Ex Post Cost-Benefit Analysis Technical Note.

New Zealand Treasury CBAx Tool and User Guidance (2023) - spreadsheet model containing a common database to help New Zealand organisations monetise impacts and do cost-benefit analysis.

International Guidance on Cost-Benefit Analysis

The Green Book (UK 2022) and accompanying guidance and documents are issued by HM Treasury to provide a framework for the appraisal and evaluation of policies, programs and projects. An updated edition is scheduled for release in early 2026, following the 2025 Green Book Review. Supplementary materials, offering more detailed guidance on specific issues and on applying the Green Book in particular contexts, include:

Climate Change and Environmental Valuation (2025) - supports analysts and policymakers to ensure that policies, programmes and projects are resilient to the effects of climate change, and that such effects are being taken into account when appraising options.

Enabling a Natural Capital Approach (2023) - provides guidance, tools, and resources for considering and incorporating the value of the natural environment for people and the economy in policy and decision-making.

Valuation of Energy Use and Greenhouse Gas (GHG) Emissions (2023) - providing specific guidance on how analysts should quantify and value energy use and emissions of greenhouse gases.

Value for Money (2022) - shows how the best value for money option is reached when applying the Green Book method.

Wellbeing Guidance for Appraisal (2021) - explains where, when and how wellbeing concepts, measurement and estimation may contribute to the appraisal of social, or public value.

Cultural and Heritage Capital Portal - brings together research, guidance and estimates to help government and private organisations consider the value of culture and heritage capital.

U.S. Office of Management and Budget - OMB Circular No. A-4: Regulatory Analysis (Nov 2023) - provides guidance to Federal agencies on how to conduct regulatory analysis, and standardizes the way benefits and costs of Federal regulatory actions are measured and reported. This Circular supersedes and rescinds the previous version of OMB Circular No. A-4, issued on September 17, 2003.

U.S. Office of Information and Regulatory Affairs - Guidance for Assessing Changes in Environmental and Ecosystem Services in Benefit-Cost Analysis (2024) - represents OMB’s recommended best practices for ecosystem services analyses in agency benefit-cost analyses.

European Commission Economic Appraisal Vademecum 2021-2027 - provides guidance on economic appraisal methodologies (including cost-benefit

analysis, cost-effectiveness analysis, least-cost and multi-criteria analysis) in support of the early screening of investments.

Economic Appraisal of Investment Projects at the European Investment Bank (2023) - presents how the EIB conducts economic appraisal (including its use of cost–benefit analysis, cost-effectiveness analysis and multicriteria analysis) across the various sectors of the economy where it operates.

Reference Case Guidelines for Benefit-Cost Analysis in Global Health and Development (May 2019) - guidelines developed out of the ‘'Benefit‐Cost Analysis Reference Case: Principles, Methods, and Standards’ project, initiated by the Bill & Melinda Gates Foundation in 2016.

OECD: Cost-Benefit Analysis and the Environment (2018) - This book explores recent developments in the theory and practice of environmental cost-benefit analysis.

New Zealand Guide to Social Cost Benefit Analysis (2015) - guidance issued by the New Zealand Treasury on carrying out social cost-benefit analysis.

United States Environmental Protection Agency Guidelines for Preparing Economic Analyses (2024) - provides a sound scientific framework for performing economic analyses of environmental regulations and policies, incorporating recent advances in theoretical and applied work in the field of environmental economics. The Guidelines provide guidance on analyzing the benefits, costs, and economic impacts of regulations and policies, including assessing the distribution of costs and benefits among various segments of the population.

European Commission Guide to Cost-Benefit Analysis of Investment Projects (2014) - practical guidance on major project appraisals including common principles and rules for application of the cost-benefit analysis approach in different sectors.

Asian Development Bank: Cost-Benefit Analysis for Development (2013) - provides an overview of recent methodological developments in cost–benefit analysis as well as suggested improvements in the economic analysis of projects in selected sectors through case studies.

Australian Technical Guidance on Cost-Benefit Analysis

Australian Government: Office of Impact Analysis Guidance Note, Value of Statistical Life (2026) - provides guidance on the use of estimates of the value of statistical life in cost-benefit analysis.

First Nations Investment Framework TPG24-28 (2024) - a guide to good practice in working with First Nations people and communities on the design, economic appraisal and evaluation of initiatives.

Valuing First Nations Cultures in Cost-Benefit Analysis (2024) - this research paper presents the key findings from NSW Treasury’s research and engagement on how CBA has been applied to First Nations initiatives to date. It explores the ways in which the value of First Nations cultures have been incorporated in CBAs, and the associated challenges and opportunities to improve current practice.

Transport for NSW Cost-Benefit Analysis Guide (2024) - sets out the principles, concepts, methodology and procedures to use when developing CBAs for NSW Transport cluster initiatives. The Guide is supported by extensive Technical Guidance which comprises a suite of frameworks, economic appraisal policies, guidelines, and tools, to support the development of CBAs.

Disaster Cost-Benefit Framework TPG23-17 (2023) - developed by NSW Treasury, the framework guides use of cost-benefit analysis for disaster resilience initiatives (disaster resilience includes the prevention, preparedness, response, and recovery phases of disaster management). The framework sets out guiding principles to support development of initiatives that support disaster resilience as well as methods, data sources, and standard parameters to support their appraisal. The Framework also includes a Flood Cost-Benefit Analysis Tool to support CBA of flood resilience initiatives. The Tool is supported by a detailed technical note with information and advice on choosing parameters, a worked example, and user manual to guide application.

Framework for Valuing Green Infrastructure and Public Spaces (2023) - developed by NSW Department of Planning and Environment together with NSW Treasury, the framework provides a standardised, robust, and comprehensive way to identify and quantify costs and benefits associated with green infrastructure and public spaces. This framework is complemented by technical apendices for recommended approaches.

Technical Note to TPG23-08: Carbon value in cost-benefit analysis - the NSW Government Guide to Cost-Benefit Analysis (TPG23–08) states that the cost of CO2 emissions (and other emissions measured in CO2 equivalent emissions), or the benefits of reduced CO2 emissions, should be included in CBA where the cost or benefit is likely to materially affect the NPV and BCR. This technical note sets out the method, consistent with the discussion in the CBA Guide, to calculate carbon values for all initiatives.

NSW Government Framework for Valuing Green Infrastructure and Public Spaces (2023) - framework providing detailed guidance for undertaking cost-benefit analysis of projects, programs and policies relating to green infrastructure and public space.

Australian Transport Assessment and Planning Guidelines - T2 Cost Benefit Analysis (2022) - CBA is the core appraisal tool in the ATAP Guidelines framework. This part of the Guidelines, ‘T2’, provides general guidance for undertaking CBA of transport initiatives and their associated options.

Infrastructure Australia Assessment Framework Guide to Economic Appraisal (2021) - guidance on various economic appraisal techniques and the circumstances in which they should be applied within the Assessment Framework.

Queensland Government Cost Benefit Analysis Guide: Business Case Development Framework (2021) - provides practical guidance for undertaking robust and transparent cost-benefit analysis in support of business cases for infrastructure proposals (supports the Stage 2: Options Analysis and Stage 3: Detailed Business Case).

NSW Health Guide to Cost-Benefit Analysis of Health Capital Projects (2018) - sets out the principles, concepts, methodology and steps to be used in the evaluation of major health capital project proposals.

Australian Government Research Report: Environmental valuation and uncertainty (2014) - general guidance for undertaking cost-benefit analysis of policies that are likely to have an environmental impact, or that are characterised by significant uncertainty.

Productivity Commission - Environmental Policy Analysis: A Guide to Non-Market Valuation (2014) - examines issues around use of non-market valuation methods in environmental policy analysis.